Hello India, ride the crypto currents with Hanoomaan!

Ethereum’s core just got a turbo boost the much-anticipated validator backbone upgrade is live, setting ETH bulls ablaze with fresh hopes of a breakout to $3,000. This state-of-the-art revamp strengthens the network’s security and efficiency, paving the way for larger-scale adoption.

Startup Menu

Crypto World

Market Movers

Crypto Frontier

Crypto Special

CRYPTO WORLD

Crypto’s resilience amid tariff noise - What smart money’s watching next?

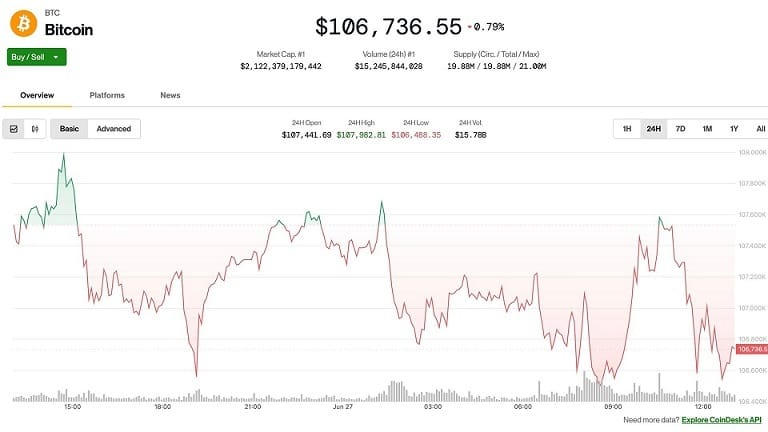

Even as fresh tariff threats ripple through traditional markets, the crypto sector appears at least for now, unfazed. Bitcoin and Ethereum traded sideways this week despite Trump’s renewed push for tariffs and a looming July policy deadline.

Why the shrug? The market seems to be betting that tariffs, while disruptive for global supply chains, don’t fundamentally derail the crypto thesis: an alternative store of value outside state control. Volatility is crypto’s DNA but so is resilience when macro headwinds hit fiat-heavy economies.

Yet, caution flags remain. Analysts are eyeing the $108K BTC level and watching for any sudden breakouts - bullish or bearish, if the tariff deadline gets pushed or amplified. Another factor? Altcoin volumes are whisper-quiet, suggesting that big players are still keeping dry powder on hand, not rushing in.

For founders, investors, and traders, the takeaway is clear: Narratives shift fast. Crypto’s immunity to tariffs may hold this time, but macro moves can trigger sharp flows in or out. Staying nimble and scenario-planning for sudden moves is smart positioning especially when politics and markets collide.

MARKET MOVERS

🐳Whale: A sudden wave of whale accumulation inside last week’s candle has SHIB believers buzzing could this stealthy buying spree foreshadow an explosive comeback? As deep-pocketed players circle Shiba Inu, retail traders are eyeing the charts for a breakout.

💰Surge: Bitcoin’s new all-time high is inching closer, with analysts now flirting with a jaw-dropping $90,000 target. Meanwhile, Dogecoin’s volume is drying up, sparking questions about its staying power. XRP, on the other hand, refuses to flinch below $0.50, could it quietly outpace the meme coin crowd?

🐕Barrier: Shiba Inu just tore through resistance, rocketing 11% and giving birth to a jaw-dropping $79.69 trillion on-chain barrier. This massive wall signals whales may be ready to lock and load for the next run.

CRYPTO FRONTIER

💸Drain: Bitcoin’s big players are quietly pulling back whale supply just hit a fresh low, hinting at strategic moves behind the scenes. As this heavyweight liquidity drains, traders are split: is BTC bracing for a stealth rally or a surprise dip? One thing’s clear the stakes just got higher.

☕Bold: In a move turning heads on Wall Street and Crypto Twitter alike, Vanadi Coffee is wagering a colossal $117 billion on Bitcoin to jolt its struggling balance sheet back to life. This unorthodox pivot could rewrite the playbook for legacy companies.

📦Stack: Metaplanet just bulked up its war chest with a hefty 1,005 Bitcoin, doubling down on crypto while traditional markets keep investors guessing. The Japan-based firm now joins the likes of MicroStrategy in this bold accumulation play.

🔥Flip: NFT markets just caught fire again racking up $125 million in sales last week, with Ethereum reclaiming the throne from Polygon. The shift signals collectors and creators are rallying back to ETH’s battle-tested network.

CRYPTO SPECIAL

The IMF, Bitcoin, and the silent battle for monetary freedom

It’s no secret that Bitcoin’s promise financial sovereignty, borderless transactions, censorship resistance makes global institutions uncomfortable. A new Bitcoin Magazine deep-dive puts the spotlight on how the IMF has become a quiet yet powerful brake on Bitcoin adoption, especially in emerging markets.

By tying loans and credit lifelines to anti-crypto clauses, the IMF is using its financial leverage to keep smaller economies plugged into the legacy system. Countries like El Salvador, which boldly made BTC legal tender, are a rare exception, most can’t risk losing IMF support, even if Bitcoin could help them dodge currency crises or reduce dependence on the dollar.

Why does this matter for the future? Because this tension isn’t about tech, it’s about power. When people and governments flirt with Bitcoin, they’re not just choosing a payment network, they’re challenging a century-old financial hierarchy.

For founders and policy watchers, the lesson is clear: expect more subtle resistance, not just from local regulators but from the global gatekeepers of monetary policy. If you’re building in crypto, you’re not just solving technical puzzles, you’re navigating a geopolitical chessboard.

Your Opinion Matters!

Got more feedback or just want to get in touch? Reply to this email and we’ll get back to you.

Thanks for reading.

Until tomorrow!

Hanoomaan Crypto Markets team

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy.