Hello India, ride the crypto currents with Hanoomaan!

U.S. stock futures surged to fresh records, unleashing a wave of optimism that analysts say could push Bitcoin into uncharted territory. As equities edge higher, crypto investors are bracing for a bullish breakout.

Startup Menu

Crypto World

Market Movers

Crypto Frontier

Crypto Special

CRYPTO WORLD

Bitcoin's ‘Double Top’ or just a breather? Sygnum bank offers a calmer take

The crypto world loves drama but not every chart pattern spells doom. According to Sygnum Bank's Patrick Tischhauser, Bitcoin’s current “double top” pattern shouldn’t trigger full-blown panic. While the price action may appear toppy near resistance zones, Tischhauser reminds us: BTC fundamentals remain intact.

Yes, there's been a slowdown in momentum. But calling for a collapse is premature. The market is consolidating after a strong run, and with no signs of leveraged froth or macro shockwaves, this could simply be a cooling-off phase before another leg up.

What matters now?

▪️ Watch institutional inflows. If they hold, the base remains strong.

▪️ Observe altcoin correlation. Lower correlation = smarter allocation.

▪️ Regulatory clarity (especially post-election) could act as a major catalyst.

Every cycle has its pause. If you're a long-term investor, Tischhauser’s calm perspective is a refreshing break from fear-driven headlines. BTC’s long-term thesis decentralized value storage and institutional validation remains as relevant as ever.

Smart investing isn’t about timing the market perfectly. It’s about reading the signs calmly and holding your ground when the storm clouds gather.

MARKET MOVERS

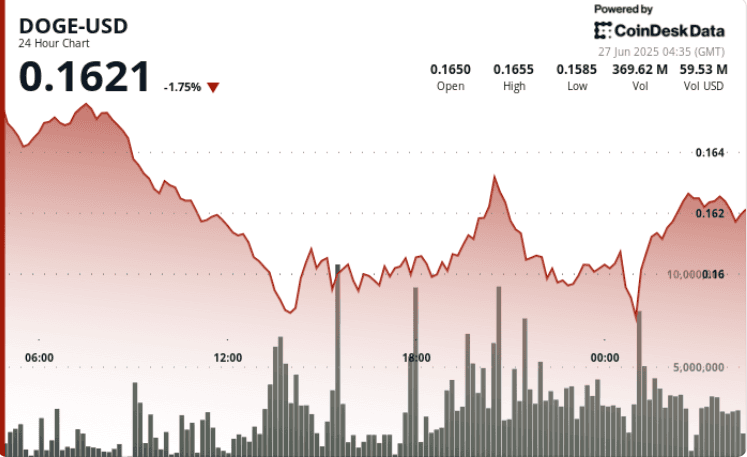

🛡️Resilience: Dogecoin found sturdy footing around the $0.16 mark, rebounding 17% from weekend lows as buyers step in. With DeFi support gaining traction via Coinbase’s wDOGE and Musk‑linked X payments on the horizon, DOGE is showing signs of a comeback.

🐕🦺Crossroads: Shiba Inu teeters at a critical junction hovering just above $0.000011 but with risk of slipping another ‘zero’ if buyers vanish. Solana’s inverted golden cross adds tension across the meme‑fi space.

📈Surge: XRP’s daily active addresses skyrocketed by a staggering 442%, driving on‑chain usage to 181K in just 24 hours. With both retail and institutional interest aligning, the project’s momentum is undeniable.

CRYPTO FRONTIER

🌱Pioneer: Indian BJP spokesperson Pradeep Bhandari just proposed a sovereign Bitcoin reserve pilot pointing to the U.S. and Bhutan as inspiration. With India’s renewable energy boom as a backdrop, he argues this could modernize finance and strengthen economic resilience.

🤖Synergy: Blockchain-based AI apps are trending on-chain activity has surged 86% and funding hit $1.39 billion in 2025, outperforming all of 2024. This isn’t hype, it’s a full-blown ecosystem taking root.

🏦Ambition: Bakkt filed with the SEC to raise up to $1 billion via securities, a strategic war chest to build its Bitcoin stash or fund future acquisitions. Think of it as a public company slotting crypto onto its balance sheet in real time.

📈Revolution: Coinbase is set to roll out U.S.-regulated nano Bitcoin (0.01 BTC) and Ether (0.10 ETH) perpetual-style futures starting July 21. This marks a milestone onshore, compliant futures that close a major gap in the market.

CRYPTO SPECIAL

🧨Coinbase vs. Retail: Is the exchange winning at the cost of its users?

Coinbase, once hailed as the champion of crypto accessibility, is now under fire for becoming what it once fought against: an opaque platform favoring its own balance sheet over retail traders.

Blockworks’ report unveils a harsh critique: Coinbase’s revenue increasingly depends on spreads and hidden costs that disproportionately affect the small investor. While the platform positions itself as “pro user,” critics argue that it’s quietly engineering a system where retail bears the brunt while institutional clients enjoy VIP lanes.

What’s at stake?

▪️ Retail users often face higher fees and lower transparency

▪️ Advanced order types and better liquidity are locked behind pro tiers

▪️ Coinbase is expanding into derivatives and custody services raising questions of user priority

This isn't just about Coinbase. It reflects a broader issue in finance and tech: when platforms scale, their incentives often shift. What begins as a democratizing force may quietly morph into a walled garden for whales.

Retail investors must stay alert. Education, alternative platforms, and decentralized exchanges are key tools in reclaiming the power that Web3 once promised. It’s time we asked harder questions about who truly benefits from the platforms we trust.

Your Opinion Matters!

Got more feedback or just want to get in touch? Reply to this email and we’ll get back to you.

Thanks for reading.

Until tomorrow!

Hanoomaan Crypto Markets team

Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy.